Insurance statutes of each state regulate the types of investments insurance companies are permitted to make, but generally defer to the NAIC APP Manual and respective investment SSAPs for recognition and valuation. Invested assets that do not qualify under any of the SSAPs are non-admitted in accordance with SSAP 4. Audited statutory financial statements must include Supplemental Investment Schedules detailing the company’s investments.

Under SAP, investments in subsidiaries and controlled and affiliated entities (SCAs) are accounted for as a single line item investment.

SSAP 1 states that majority-owned subsidiaries should not be consolidated because such consolidation would be inconsistent with the recognition concept in the Statement of Concepts, which states that one objective of statutory accounting is to reflect a company's ability to meet its policyholder obligations with the existence of readily marketable assets available when both current and future obligations are due. With an investment in a subsidiary, the cash flow generated by the investee may not be available to satisfy policyholder obligations. Therefore, the insurance company asset that is readily marketable is the shares of ownership (e.g., common or preferred stock). Consolidated financial statements are only prepared when permitted by the domiciliary department of insurance. For similar reasons, the NAIC has also explicitly rejected GAAP guidance related to consolidation when an entity is determined to be the primary beneficiary of a variable interest entity.

SSAP 97, Investments in Subsidiary, Controlled, and Affiliated Entities, addresses the accounting for SCAs. In order to be an admitted asset, the investment must be audited. For SSAP 48 entities for which more than 10% is owned by the insurer, SSAP 97 is also required to be followed.

SSAP 97, Investments in Subsidiary, Controlled, and Affiliated Entities, and its Implementation Questions and Answers provide the following guidance on the audit requirements necessary to admit the SCA asset:

SSAP 97, Investments in Subsidiary, Controlled, and Affiliated Entities, addresses the accounting for SCAs. SCAs are reported using an equity method based on the reporting entity’s shares of the audited statutory equity of the SCAs financial statements (for insurance SCA entities), audited GAAP equity, or audited GAAP equity with specified adjustments depending on the type of SCA entity. The change in the carrying value between reporting periods must be recorded as an unrealized gain/loss through surplus.

The "equity pick up" of surplus of an insurance company investee is not necessarily the entire "capital and surplus" balance. Per SSAP 97, the carrying value of an insurance company after initial acquisition is the original acquisition cost adjusted for the insurer's share of changes in unassigned funds, "special surplus funds," and "other than special surplus funds." Surplus notes are excluded from the carrying value of the subsidiary in the parent company financial statements. When surplus notes are issued by a subsidiary and held by the parent insurer, these investments are accounted for by the parent as Schedule BA assets. When the surplus notes are issued to an entity other than the parent, the parent insurer cannot record any value for the surplus notes because it is not capital from the parent company's perspective (i.e., it is akin to a minority interest). In 2018, the NAIC issued guidance relating to the reverse situation (i.e., SCA entities owning surplus notes issued by the parent). SSAP 97 and SSAP 41 were amended to clarify that surplus notes should be eliminated in the parent insurer’s surplus if the SCA acquires any portion of outstanding surplus notes issued by the parent.

Another adjustment to the equity pickup is for non-controlling interests for entities valued using US GAAP equity. The component of GAAP equity that represents non-controlling interests should be excluded from the insurer's investment as it is not part of the insurer's "share of the audited GAAP basis" (paragraph 11 of SSAP 97).

The carrying value of certain SCAs (SSAP 97 paragraphs 8.b.ii and 8.b.iv entities) is adjusted audited GAAP equity. The required adjustments are listed in SSAP 97 paragraphs 9.a through SSAP 97 paragraph 9.g. Note that the adjustments for goodwill and deferred tax assets (SSAP 97 paragraphs 9.d and 9.e) are based on 10% of equity of the investee, not the parent insurance company investor. The schedule to adjust from audited US GAAP to adjusted audited GAAP is not included in the audited financial statements. The insurer prepares the schedule in connection with the preparation of the parent entity financial statements, as the adjusted equity represents the parent insurance company's carrying value in its SCA investment.

When an insurance company directly acquires another insurance company in a transaction that results in statutory goodwill (the difference between the historical statutory book value of the acquired entity and the purchase price), the goodwill is part of the carrying value of the acquired entity on the insurance company's balance sheet as an investment in common stock. Therefore, for investments in acquired insurance companies, there will be a difference between total capital and surplus per the investee's annual statement and audited statutory financial statements and the carrying value in the insurance company parent's financial statements, unless the purchase price for the acquired entity equaled its statutory book value at the acquisition date. The goodwill is limited to 10% of capital and surplus (adjusted to exclude admitted net positive goodwill, EDP equipment, and operating system software), and is amortized by the insurance company parent to unrealized gain/loss on investments. Also, note that goodwill cannot be pushed down to the books of the acquired insurance entity. In addition, when an acquired entity is subsequently merged into another entity, the goodwill is required to be written off immediately to surplus per SSAP 68, paragraph 13.

In 2018, the NAIC adopted a revision to SSAP 68 to clarify that “cancelling equity of an owned entity, without issuance of new equity, and incorporating the assets and liabilities of the owned entity directly within the reporting entity’s financial statements (e.g., dissolving the SCA entity and absorbing their assets and liabilities)” also qualifies as a statutory merger.

The carrying value of an investee can be less than $0 in two circumstances. Per SSAP 97 paragraph 13.e, the insurance company should provide for its share of losses after reducing its investment balance to $0 when the insurer has guaranteed obligations of the investee or is otherwise committed to provide further financial support. In addition, noninsurance entities valued in accordance with SSAP 97 paragraph 8.b.ii that hold only nonadmitted assets would also be valued at negative equity by the parent insurer if the value of the nonadmitted assets exceeds total equity. The other adjustments required to US GAAP for SSAP 97 paragraph 8.b.ii entities that are listed in SSAP paragraph 9 could also result in negative equity. This guidance is consistent with Question 7 in the SSAP 97 Implementation Q&A. An insurer is not permitted to forgo an audit and record a nonadmitted asset (i.e., with zero value) to avoid this treatment.

All basis differences between cost/purchase price and the underlying GAAP equity should be amortized, similar to goodwill. This includes minority owned (less than 10%) SSAP 48 entities that are not scoped into SSAP 97. SAP also requires the basis differences to be included with goodwill for purposes of determining the 10% goodwill limitation.

Insurance companies that purchase other insurance entities, either directly or through a non-insurance downstream holding company, are required to include any goodwill related to the purchase in their goodwill limitation calculation. In 2019, the NAIC clarified that goodwill resulting from the application of pushdown accounting by an insurer to a non-insurance SCA is required to be included in the 10% goodwill limitation calculation. However, when insurance companies own non-insurance entities valued using US GAAP equity and those non-insurance entities acquire other non-insurance companies, the insurance entity parent companies are not required to include the goodwill in their goodwill limitation calculation if the goodwill is pushed down to the acquired downstream GAAP entity. However, pushdown is not required if a downstream non-insurance holding company owned by the insurer purchases the non-insurance GAAP entity. The NAIC continues to review the accounting for goodwill held in various holding company structures, and additional discussion and guidance is expected in 2021, which could change this guidance.

Insurance entities are required to disclose a detail listing of directly owned SSAP 97 SCA entities. However, this excludes insurance SCA’s and all SSAP 48 entities, including those that are affiliates of the insurer (which is generally ownership of 10% or more of the SSAP 48 entity).

In practice, questions have arisen in terms of how a company or filer treats the goodwill from the acquisition of a holding company that owns insurance and non- insurance companies that were purchased by a downstream holding company subsidiary of an insurance company. There are two acceptable approaches for viewing this transaction under SSAP 97, both of which result in the same answer. One approach would be for the filer to account for the investment in an SCA, and that investment must include goodwill, whether it has been pushed down or not. Therefore, when the filer applies the provisions of SSAP 97, the downstream insurance company acquired will be valued at its statutory carrying amount, which would include goodwill (including applying the goodwill limitations).

The alternative approach is that the goodwill is pushed down to the SCA and, therefore, the filer must value the insurance company acquired, including goodwill at its statutory carrying amount, or the goodwill is at the holding company. If the filer believes that the goodwill is at the holding company, the filer must apply the provisions of SSAP 97 paragraph 21.e, which would require the other assets of the holding company to be accounted for in accordance with statutory accounting principles and, again, the goodwill limitations must be applied. The NAIC is discussing and expected to issue guidance in 2021 on goodwill in holding company structures, which could result in revisions to this guidance.

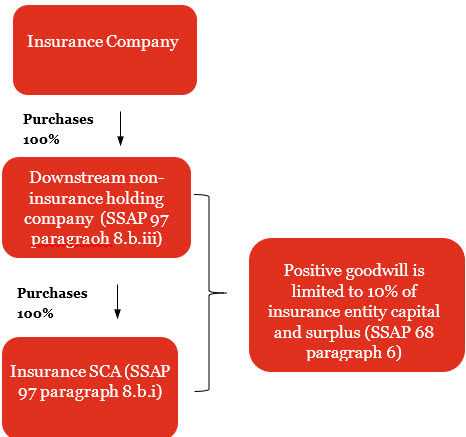

Example IG 13-1 and Example IG 13-2 illustrate the goodwill admissibility guidance under SSAP 97.EXAMPLE IG 13-1

SSAP 97 goodwill admissibility – purchase of an SCA accounted for under SSAP 97 paragraph 8.b.iii

Insurance Company purchases a downstream non-insurance holding company SCA accounted for under SSAP 97 paragraph 8.b.iii. Subsequently the non-insurance holding company purchases a non-insurance SCA accounted for under SSAP 97 paragraph 8.b.iii.

How would goodwill be accounted for in both acquisitions? AnalysisAs depicted below, the goodwill from the acquisition of the non-insurance downstream holding company SCA accounted for under SSAP 97 paragraph 8.b.iii is limited to 10% of the insurance reporting entity's capital and surplus whether the goodwill is pushed down or not. However, when the non-insurance downstream holding company purchases a non-insurance SCA accounted for under SSAP 97 paragraph 8.b.iii, the goodwill is limited to 10% of Insurance Company’s capital and surplus only when it is not pushed down to the lower-tier non-insurance SCA. This is because SCAs accounted for under paragraph 8.b.iii are valued at audited GAAP equity without adjustment.

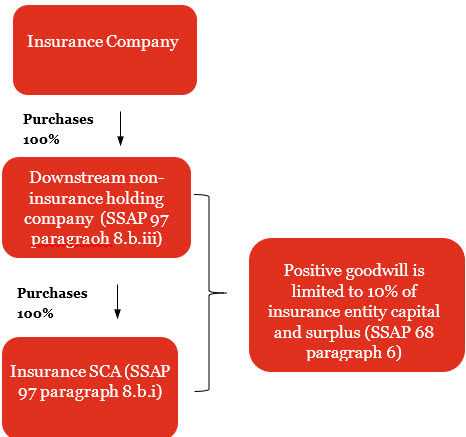

EXAMPLE IG 13-2

SSAP goodwill admissibility guidance - purchase of an SCA accounted for under SSAP 97 paragraph 8.b.i

Insurance Company purchases a downstream non-insurance holding company SCA accounted for under SSAP 97 paragraph 8.b.iii that subsequently purchases a US insurance SCA accounted for under paragraph 8.b.i.

How would goodwill be accounted for in the purchase of the US insurance SCA? AnalysisAs depicted below, since Insurance Company purchased a US insurance SCA under paragraph 8.b.i (either directly or indirectly through a downstream holding company), goodwill is limited to 10% of the insurance reporting entity’s capital and surplus. Pushdown of goodwill is not permitted for US insurance SCAs.

SSAP 26R, SSAP 30, SSAP 32, SSAP 37, SSAP 39, and SSAP 43R describe the statutory accounting for debt and equity securities. Unrealized gains and losses on equity securities and bonds valued at the lower of cost or fair value are recorded in surplus. Prior to the adoption of ASU 2016-13, which modifies the existing GAAP impairment model for available for sale (AFS) debt securities, there is generally no difference between SAP and GAAP with respect to whether an investment is other-than-temporarily impaired for (1) stocks and (2) SSAP 26R bonds for which the impairment is credit-related, not interest related. There may be some circumstances when a GAAP credit-related impairment may not be recorded for SAP on SSAP 26R bonds. Interest-related losses on non-loan backed bonds are only recognized when the insurer has the intent to sell an investment, at the reporting date, before recovery of the cost of the investment. Note that for SSAP 26R bonds that have been determined to be other-than-temporarily impaired, the entire difference between fair value and carrying value is recorded as a realized loss, which differs from the guidance in GAAP.

After the adoption of ASU 2016-13, the AFS debt security model under GAAP differs from the statutory impairment model in that it no longer allows consideration of the length of time during which fair value has been less than its amortized cost basis when determining whether a credit loss exists. Under SAP, for SSAP 26R bonds that have been determined to be other-than-temporarily impaired, the entire difference between fair value and carrying value is recorded as a realized loss. That differs from GAAP, in which only the portion of the impairment related to credit losses is recorded in an allowance for credit losses account with an offsetting entry to realized loss and any portion not related to credit losses is recorded through other comprehensive income. GAAP also differs from SAP as the GAAP allowance for credit losses can be reversed for subsequent increases in expected cash flows (see LI 8 for more information on the GAAP AFS impairment model). ASU 2016-13 also changes the impairment model for held-to-maturity debt securities and requires entities to record lifetime expected credit losses for these securities, which are also recorded through an allowance account (see LI 7.3). ASU 2016-13 is effective in 2020 for SEC filers other than small reporting companies (SRCs) and effective in 2023 for all other companies, including SRCs.

SSAP 56 prescribes the statutory accounting for investments held through separate accounts in both the general account and separate account statements. SAP differs from GAAP in that seed money is always included with separate account assets in the single line treatment on the insurer's balance sheet. SAP has also not adopted ASC 944-80, including the required criteria to allow separate account assets as a single line item in the balance sheet. As a result, more separate accounts receive the single line item presentation in the balance sheet for SAP than for GAAP. In addition, under SAP, separate account assets always equal separate account liabilities.

SSAP 100R, provides statutory guidance for fair value measurements and disclosure requirements. It adopts the majority of the ASC 825-10 guidance, with one significant exception: SAP did not adopt the guidance regarding the consideration of non-performance risk (own credit risk) in determining the fair value measurement of liabilities after initial recognition because it is not consistent with the statutory concepts of conservatism.

The statutory accounting for equity securities is included in SSAP 30 and SSAP 32. For statutory purposes, redeemable preferred stocks are reported similar to a debt security. Highly rated non-redeemable preferred stocks (NAIC 1-3 designated securities held by life companies and NAIC 1-2 designated securities held by non-life companies) are valued at amortized cost; all other non-redeemable preferred stock is valued at the lower of cost or fair value.

Temporary changes in the value of common stocks and certain non-redeemable preferred stocks are recognized as unrealized gains or losses and shown net of income tax as a separate component of policyholders' (stockholders') equity under SAP. On an SAP basis for life companies, these changes are also recognized as part of the Asset Valuation Reserve calculation.

Temporary changes in the fair value of equity securities valued at amortized cost do not require a write down of amortized cost; other-than-temporary impairments of equity securities are recognized in income.

Under SAP, for reporting entities that maintain an asset valuation reserve (AVR), bonds are reported at amortized cost, except for those with an NAIC designation of 6, which are reported at the lower of amortized cost or fair market value. For reporting entities not required to maintain an AVR, bonds that are designated highest-quality and high-quality (NAIC designations 1 and 2, respectively) are reported at amortized cost; with all other bonds (NAIC designations 3 to 6) reported at the lower of amortized cost or fair market value. Changes in the fair value of non-impaired bonds valued at fair value are recorded in net unrealized capital gain/loss reported in surplus. If impairment of a non-loan backed bond (SSAP 26R bond) is deemed to be other than temporary, the bond is written down to fair value with the impairment loss recorded in income.

The NAIC has adopted impairment guidance which provides that, in periods subsequent to the recognition of an other-than-temporary-impairment loss for a debt security, the insurer should account for the security as if the security had been purchased on the measurement date of the other-than-temporary impairment. The fair value of the security on the measurement date becomes the new cost basis, and the discount or reduced premium, based on the new cost basis, is amortized in the prospective manner over the remaining period in which repayment of principal is expected to occur. This impairment guidance applies to non-loan backed (SSAP 26R) bonds and preferred stock.

In accordance with SSAP 43R, Loan-Backed and Structured Securities, for securities for which the fair value is less than amortized cost, and either (1) the insurer has the intent to sell the security or (2) the insurer does not have the intent and ability to retain the security until recovery of its carrying value, insurance entities are required to recognize an impairment in earnings equal to the difference between the security's fair value and its carrying value. The fair value at the time of the impairment becomes the security's new cost basis. For securities for which the insurer does not expect to recover its amortized cost basis, but has the intent and ability to hold the security until maturity, the insurer will recognize in earnings a realized loss of only the "non-interest" related decline (as defined by footnote 8 to SSAP 43R). SSAP 43R does not permit a reporting entity to change its assertion regarding its intent to sell or lack of ability and intent to hold a security until recovery of its amortized cost basis. The new carrying value will be calculated as the present value of cash flows expected to be collected based on an estimate of the expected future cash flows of the impaired loan-backed bond, discounted using an effective interest rate which varies depending on the type of security, as specified by SSAP 43R. The interest-related impairment is not recognized in earnings or surplus.

For entities subject to an asset valuation reserve and interest maintenance reserve, paragraph 37 of SSAP 43R requires that the non-interest related portion of the other-than-temporary impairment loss be recorded in AVR and the interest-related other-than-temporary impairment loss be recorded in IMR, even if the security was written down to fair value because the insurer has the intent to sell the security or because the insurer does not have the intent and ability to hold the security until recovery of its cost basis. This guidance is different from the AVR/IMR treatment for non-loan backed bonds, which prohibits bifurcation of the OTTI loss into AVR and IMR components. SSAP 43R also requires that the gain or loss on the sale or all SSAP 43R bonds be bifurcated into its interest (IMR) and other than interest (AVR) components. For SSAP 43R securities, this may result in the previously reported AVR or IMR being recaptured on subsequent sales of impaired securities. However, this is not applicable for SSAP 26R securities, which record realized gains and losses to IMR unless the rating is different by more than 1 rating class between the beginning and ending of the holding period.

SSAP 43R (paragraph 32) requires the entity to assess whether it has the intent and ability to hold the security for enough time to recover the amortized cost basis. Impairment should be recognized if the entity does not have the intent and ability to hold the investment for the time necessary to recover the amortized cost basis. A footnote to paragraph 32 (FN 7) states the following: "this assessment of intent and ability shall be considered a high standard due to the accounting measurement method established for the securities within the scope of this Statement (amortized cost)." SSAP 43R, Appendix A, Question 5 recognizes that a change in management's assertion may occur based on new information becoming known in subsequent periods or changes in facts and circumstances relating to a particular security. However, if a reporting entity previously asserted the intent and ability to hold a security until recovery but subsequently sells or otherwise disposes of that security at a loss, the entity must be prepared to justify why the subsequent sale does not call into question similar assertions for securities that are still held by the entity. Given the similarity of the "intent and ability" language in SSAP 43R with prior GAAP (pre FSP 115-2) other-than-temporary impairment guidance, we believe consideration should be given to prior GAAP guidance when assessing whether subsequent sales may call into question (taint) management's assertion regarding remaining securities. With respect to impairment and subsequent investment income recognition, SSAP 43R adopts only three paragraphs of SOP 03-03 (5, 7, and 9) which have been codified in ASC 310-30; the remainder of that guidance and ASU 2016-13 are still under consideration by the NAIC.

SSAP 103R, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, requires that most securities lending arrangements be recorded on the balance sheet. Only those arrangements in which the collateral received may not be sold or repledged by the transferor or its agent may be off balance sheet.

Security lending arrangements in which the collateral may be sold or repledged are presented in financial statements in one of two ways.

For securities lending programs administered by insurer's affiliated agent, the insurer has the option to use the "one-line" presentation or report the collateral as part of other investment categories. Schedule DL is used to provide additional detail of an insurer's securities lending program including fair value, book value, and maturity date of all collateral assets.

All life and health insurance companies and fraternal benefit societies are required to include an interest maintenance reserve (IMR) in their statutory Annual Statement in accordance with SSAP 7. The NAIC also codified a "Blue Book," which is comprised of Q&As and other guidance to assist companies on the accounting and reporting of AVR and IMR.

The IMR captures realized capital gains and losses from the sale of fixed income investments resulting from changes in the overall level of interest rates. Realized gains and losses that are considered "credit related" (as defined) are excluded from the IMR and are included in the AVR calculation. The purpose of the IMR is to minimize the effect that realized gains and losses arising from interest rate movements have on surplus, as well as to stabilize statutory surplus against fluctuations in the market value of securities as cash flows of assets and liabilities are matched. IMR is calculated in accordance with the NAIC, Annual Statement Instructions for Life and Accident and Health Insurance Companies. All realized gains and losses (net of tax) classified as interest-related are accumulated and are amortized into net income on a basis reflecting the remaining period to maturity of the assets sold. Companies generally use one of two methods to allocate tax to realized gains: the statutory tax rate or the company's effective tax rate. Whichever method is used should be used consistently. A net deferred loss that otherwise would have been classified as an asset is treated as non-admitted and carried over to the following year. There are two prescribed methods for calculating IMR amortization, the seriatim method, and the grouped method. The latter method accumulates the realized gains and losses according to the number of years to expected maturity and is less complicated to calculate than the seriatim method.

There are very specific and complex rules for the treatment of IMR when a large block of business is reinsured. In general, the ceding company releases the IMR associated with the block of business reinsured, and the assuming company records a liability for IMR in the amount of IMR released by the ceding company. See the life and health Annual Statement instructions for more detail.

In accordance with SSAP 40R, property occupied by the reporting entity (e.g., home office property) is classified as an investment and carried at depreciated cost less encumbrances, unless events or circumstances indicate that the carrying amount of the asset may not be recoverable. SSAP 90, Accounting for the Impairment or Disposal of Real Estate Investments, Discontinued Operations, is consistent with GAAP guidance, with certain modifications, including guidance on assessing impairment on property occupied by the reporting entity. Reporting entities should look to the guidance in SSAP 90 for events or changes in circumstances that indicate that the recoverability of real estate should be assessed. In cases when recoverability is assessed and the asset is impaired, the reporting entity should write the asset down to its fair value, determined in accordance with SSAP 90, thereby establishing a new cost basis. The impairment loss is recorded in the summary of operations as a realized loss. SSAP 40R continues to require that insurance companies occupying home office properties record equal amounts of rental income (investment income) and expense (operating expense) related to such occupancy. The amount recorded should be at a rate comparable to rent received from others and/or rental rates of like property in the same area. Although appraisals are required every five years for real estate held for sale and held for the production of income, this requirement does not extend to real estate occupied by the reporting entity.

Certain assets designated as non-admitted assets (e.g., furniture and non-EDP equipment), as discussed in SSAP 20, are not recognized as an asset for SAP because they are not available to meet current and future obligations and cannot be used to fulfill policyholder obligations. The change in non-admitted assets between years is charged or credited directly to surplus.

Insurance companies are subject to statutory limitations regarding the amount of a particular investment that may be held. Such limitations may include restrictions as to what percentage of the total portfolio a given investment type may represent (e.g., real estate investments) or may be related to the financial condition of the investee (e.g., non-investment grade securities). Such regulations vary from state to state and, accordingly, statutes of the state of domicile should be referred to for appropriate guidance and should be reviewed periodically. Many states' investments requirements include a "basket provision" that allows the excess of permitted investments to be admitted as part of the "basket." The New York State statutes (Sections 1401 through 1410) are generally considered to be the most stringent; therefore, many companies use them as a standard for investment limitations.

Some insurers may invest in an investment pool with other entities in their holding company group in which the affiliated companies transfer cash to the pool which is then used to purchase investments. The insurer may consider the arrangement to be similar to an investment in a mutual fund and, accordingly, may believe that recognition on Schedule D is appropriate. However, the pool may not legally be structured as an investment company (i.e., it may not issue "shares," etc.) and may not have been filed with the NAIC’s securities valuation office (SVO). When the investment is not filed with the SVO, the company should consult with the domiciliary regulator to determine the appropriate accounting treatment, including consideration as a permitted practice.

Under statutory accounting, a mortgage loan is considered impaired when it is probable the reporting entity will be unable to collect all amounts due in accordance with the contractual terms of the mortgage agreement. The fair value of a mortgage loan is the fair value of the collateral less costs to sell. For loans that are in default, being voluntarily conveyed, or being foreclosed, the carrying value is adjusted for additional expenses, such as insurance, taxes, and legal fees that have been incurred to protect the investment or to obtain clear title to the property to the extent that these amounts are deemed to be recoverable from the ultimate disposition of the property. However, if these costs cannot reasonably be expected to be recovered, they should not be added to the carrying value, and should instead be expensed.

Under statutory accounting, property held for the production of income is reported at depreciated cost less encumbrances unless events or circumstances indicate that the carrying amount may not be recoverable. Impairment should be measured and assessed in accordance with SSAP 90. Property that the entity has the intent to sell or is required to sell is classified as held for sale and carried at the lower of depreciated cost or fair value less encumbrances and estimated costs to sell (consistent with GAAP guidance). In either case, fair value is determined by an appraisal that considers the present value of future cash flows generated by the property, a physical inspection of the property, current sales prices of similar properties, and costs to sell the property in accordance with SSAP 40R. Appraisals of properties held for sale and for the production of income must be obtained at least every five years.

SSAP 86, Accounting for Derivative Instruments and Hedging, Income Generation, and Replication (Synthetic Asset) Transactions, uses selected concepts from GAAP and addresses the recognition and measurement of derivatives used in hedging transactions, income generation transactions, and replication (synthetic asset) transactions. While not often resulting in different classification between GAAP and SAP, the SSAP 86 definition of derivatives differs from the GAAP definition, as SAP does not require net settlement. SSAP 86 adopts the hedge effectiveness standards and documentation standards of GAAP but differs from GAAP in that it rejects the concept of embedded derivatives and the requirement to mark all derivatives to market. Under SSAP 86, effective hedges are accounted for "consistent with the item being hedged." Therefore, derivatives that hedge investments in bonds are carried at amortized cost with no recognition of changes in fair value of the derivative. Derivatives that hedge investments in common stock are marked to market through surplus. Ineffective hedges that do not meet hedge criteria standards at inception or no longer meet hedge effectiveness criteria are recorded at fair value with changes in fair value recorded directly to surplus, not through investment income. SSAP 86 adopts other GAAP guidance related to the accounting for derivatives and hedging activities and related implementation technical guidance "to the extent that such guidance is consistent with the statutory accounting approach to derivatives utilized in [SSAP 86]."

All life and health insurance companies and fraternal benefit societies are required to include a reserve in their statutory Annual Statement, described as an Asset Valuation Reserve (AVR) for their stock, bond, mortgage, real estate, and other invested assets. The purpose of the AVR is to decrease the volatility of the incidence of asset losses and to recognize the long-term return expectations for investments. The AVR contains a default component (which comprises bond, preferred stocks, short-term investments, and mortgage sub-components) and an equity component (which comprises common stock, real estate, and other invested asset sub-components). The AVR is limited to maximums by sub-components but cannot be less than zero for any sub-component. The increase or decrease to this reserve is charged or credited directly to surplus. Unrealized gains included in the AVR calculation should be presented net of deferred taxes, similar to the way in which realized gains are shown net of capital gains taxes.

Companies issuing variable annuity products with certain guarantees may seek to hedge those guarantees by purchasing freestanding derivative instruments. The AVR instructions state that realized and unrealized gains and losses on derivatives hedging assets are to be included in AVR and also require an AVR charge for the counterparty credit risk associated with derivatives in an asset position (regardless of whether they hedge assets or liabilities or do not function as a hedge). Most interpret the AVR instructions to require that realized and unrealized gains and losses on derivatives hedging liabilities (i.e., equity, not credit-related, gains and losses) should not be included in AVR.

The AVR is calculated in accordance with the annual instructions contained in the NAIC, Annual Statement Instructions for Life and Accident and Health Insurance Companies and include a full listing of AVR-exempt securities.

PwC. All rights reserved. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.